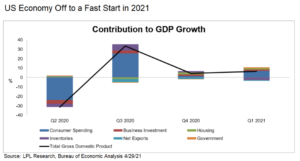

In what was initially expected to be one of the slower quarters of the year, the U.S. economy jumped out of the gates in 2021, with gross domestic product (GDP) growing 6.4% quarter over quarter. A faster than expected vaccination program, nearly $3 trillion in fiscal stimulus—including direct payments to consumers—and faster than expected job growth helped fuel a surge in personal consumption—the largest portion of GDP.

As shown in the LPL Chart of the Day, personal consumption grew 10.7% on an annualized basis in the first quarter, the second highest level since the 1960’s:

“The U.S. economy is off to a great start in 2021, and this should set the stage for solid growth in the remainder of the year as pent up demand continues to flow through the economy,” added LPL Financial Chief Investment Officer Burt White. “Many areas of the country are still facing restrictions on activity, so we don’t think growth will just be limited to the first quarter.”

However, the growth story in the first quarter wasn’t solely about direct stimulus payments. While personal consumption has understandably gained a lot of attention, federal non-defense spending added the most to GDP in nearly 60 years, a segment of the economy unaffected by transfer payments like stimulus checks.

Digging into the numbers even further, spending on services grew a modest 4.6%, which should accelerate in the second and third quarters as remaining restrictions are lifted in response to falling cases and rising vaccinations. As of April 28, the US is averaging around 2.5-3 million vaccines administered per day, which has helped over half the adult population receive at least one dose of the vaccine, while nearly 40% of adults are fully vaccinated, according to the Center for Disease Control and Prevention.

The U.S. vaccination program has helped pull the economy forward, but net trade was a modest drag on growth in the first quarter, where domestic growth pulled in imports at a faster pace than the recovery outside of the U.S. lifted exports. As the rest of the world gets better control of COVID-19, rebounding economic growth overseas should provide an additional tailwind for U.S. economy.

We upgraded our forecast for U.S. GDP in our recent Weekly Market Commentary from 5–5.5% to 6.25–6.75%, and we expect to see the economy continue its pace in the second quarter as restrictions are lifted and activity normalizes.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and Bloomberg.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value